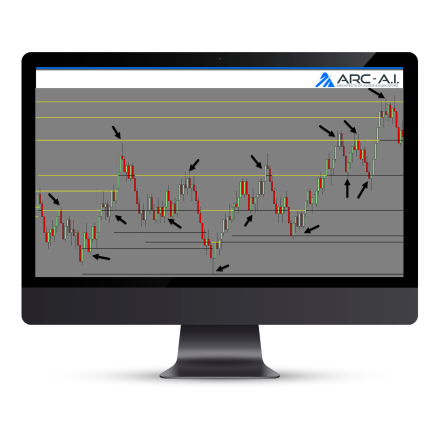

Pattern Finder Indicator Overview:

Pattern Finder is an all-inclusive multi timeframe pattern recognition trading system and pattern scanner signal generator. It comes with pre-configured signals, buy and sell pattern signals and global asset scanners for locating potential and confirmed trades.

Purpose:

Traders need the Pattern Finder Indicator because trading breakout patterns requires fast execution within narrow time windows. It is very difficult with the naked eye to recognize pattern setups even for a single market on one timeframe. The level of difficulty increases dramatically more when you want to scan multiple markets across different timeframes. It is simply humanly impossible to do this without using software to do this for you. Using the Pattern Finder allows you to let the software scan all markets and instantly provide valid setups so you can simply focus on trading.

Elements:

- M Patterns

- W Patterns

- Multi Timeframe

- Scan Multiple Markets

- Market Analyzer Signal Columns

- Semi Automated Trade Planning

- Easy to Read Chart Signals and Graphics

- Differentiate Potential and Confirmed Patterns

Functions:

The Pattern Finder is best used by letting the software do all the heavy lifting to process all the incoming price action data to identify confirmed patterns for breakout entries. Setting up a scanner which scans all markets that you want to trade across multiple timeframes will make it easy to find legitimate opportunities and filter out the false signals. This greatly reduces the amount of mental analysis required and makes it easier to focus on risk parameters and trade management once trades are entered.

Problem Solved by our Pattern Finder Indicator:

- Stops traders from second guessing breakout patterns

- Stops traders from getting stopped out on fake out breakouts (FOBO)

- Stops traders from missing good trade setups

- Stops traders from entering at the wrong times and wrong direction

- Stops traders from getting confused by too much information to process

- Stops traders from losing confidence in their strategy