Overview:

Easy Trader is an all-inclusive Trade Execution solution, focused on Trade Planning, Trade Management, and Risk Management. Its unique design capabilities operate as an indicator, not a strategy making this cutting-edge trade execution software.

Purpose:

Trade management involves more than just entering trades. Traders need to plan in advance their risk exposure along with the details of how they intend to manage the trade. The EasyTrader allows for all of this in one user integration and this makes it user friendly and easier to manage their business without having multiple toolsets to cater to while instead using the EasyTrader as an all in one solution.

Easy Trader Elements:

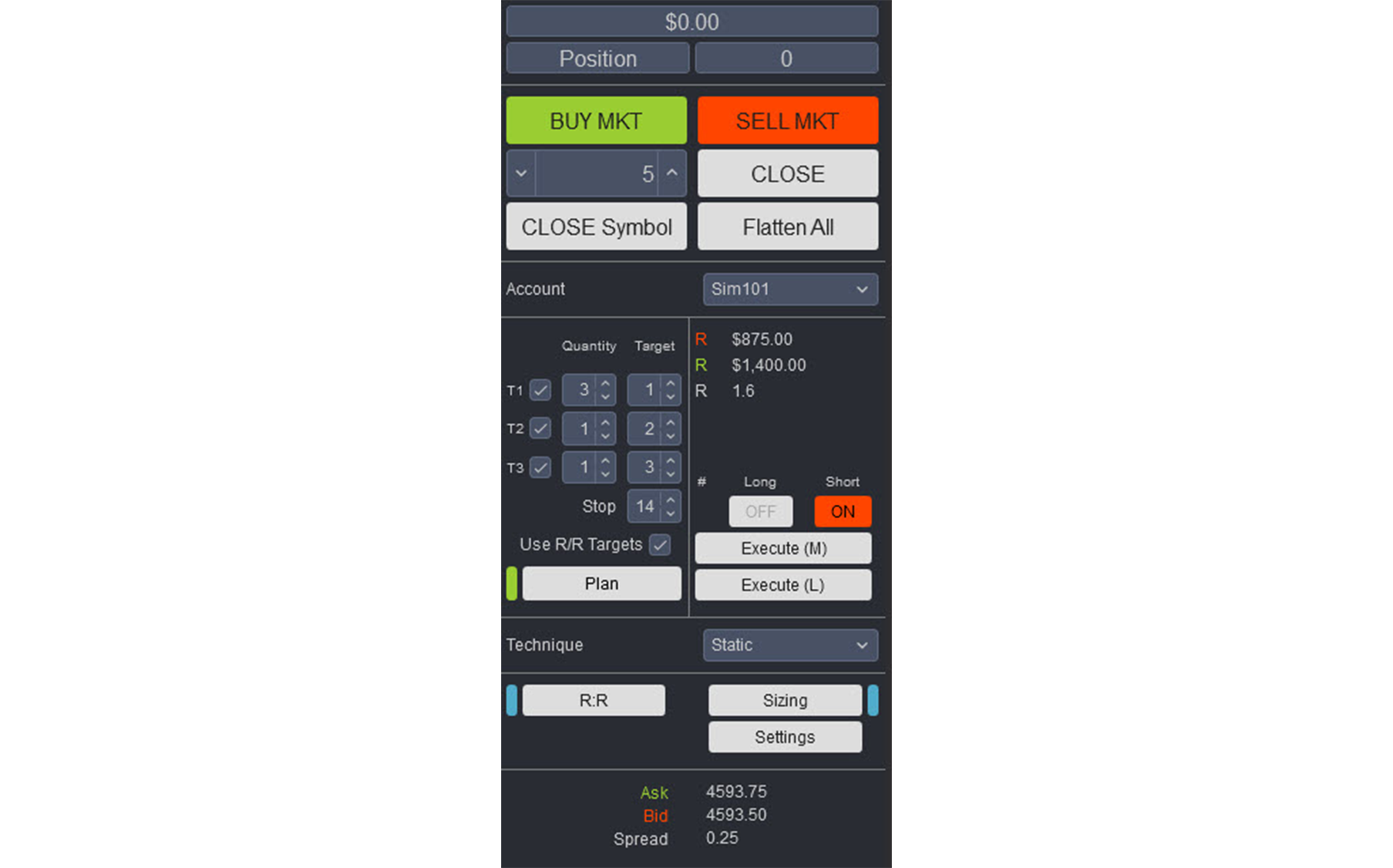

The following components make up the Easy Trader’s main functions:

- Customizable Trade Plan with up to 3 Targets

- Risk Reward Targets

- Fixed Fractional And Dollar Sizing

- Easy Click and Drag Stop and Target Adjustment

- Market or Limit Execution

- Easy to Read Risk Reward Metrics

Functions:

Easy Trader is best designed to be used as an all-in-one tool to efficiently handle all aspects of trade planning, trade execution and management, and risk sizing. Taking this approach can simplify the complex task of managing your trading business.

Problem Solved:

- Stops traders from second guessing risk management

- Stops traders from second guessing trade management

- Stops traders from trading to much or too little size

- Stops traders from breaking their rules

- Stops traders from long chart setups and prep times

- Stops traders from missing trades while planning for them

"EasyTrader Lean does not have the same features as EasyTader. Be aware of these differences prior to purchasing EasyTrader Lean".