ATRCurve

THIS PRODUCT IS INCLUDED WITH THE ALL-IN-ONE SUBSCRIPTION

- 30+ Proprietary Algos

- 50+ Advanced Indicators

- 4 Complete Trading Systems

- In-Depth User Documentation

- White Glove Installation & Ongoing Support

- Prebuilt Optimized Strategy Templates

- Deep-Dive Video Courses & AMA Sessions

Only for Ninjatrader Platform

Overview:

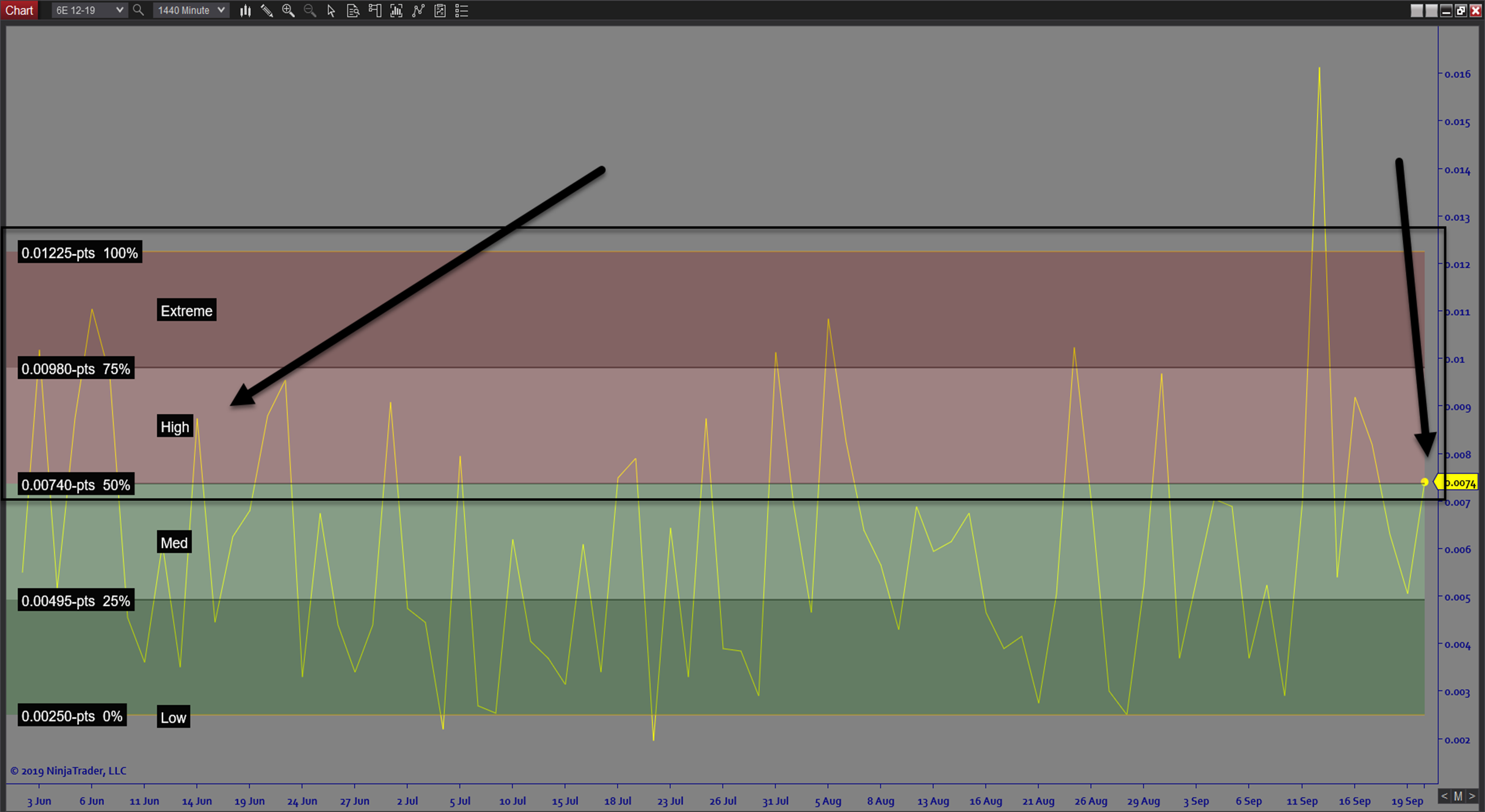

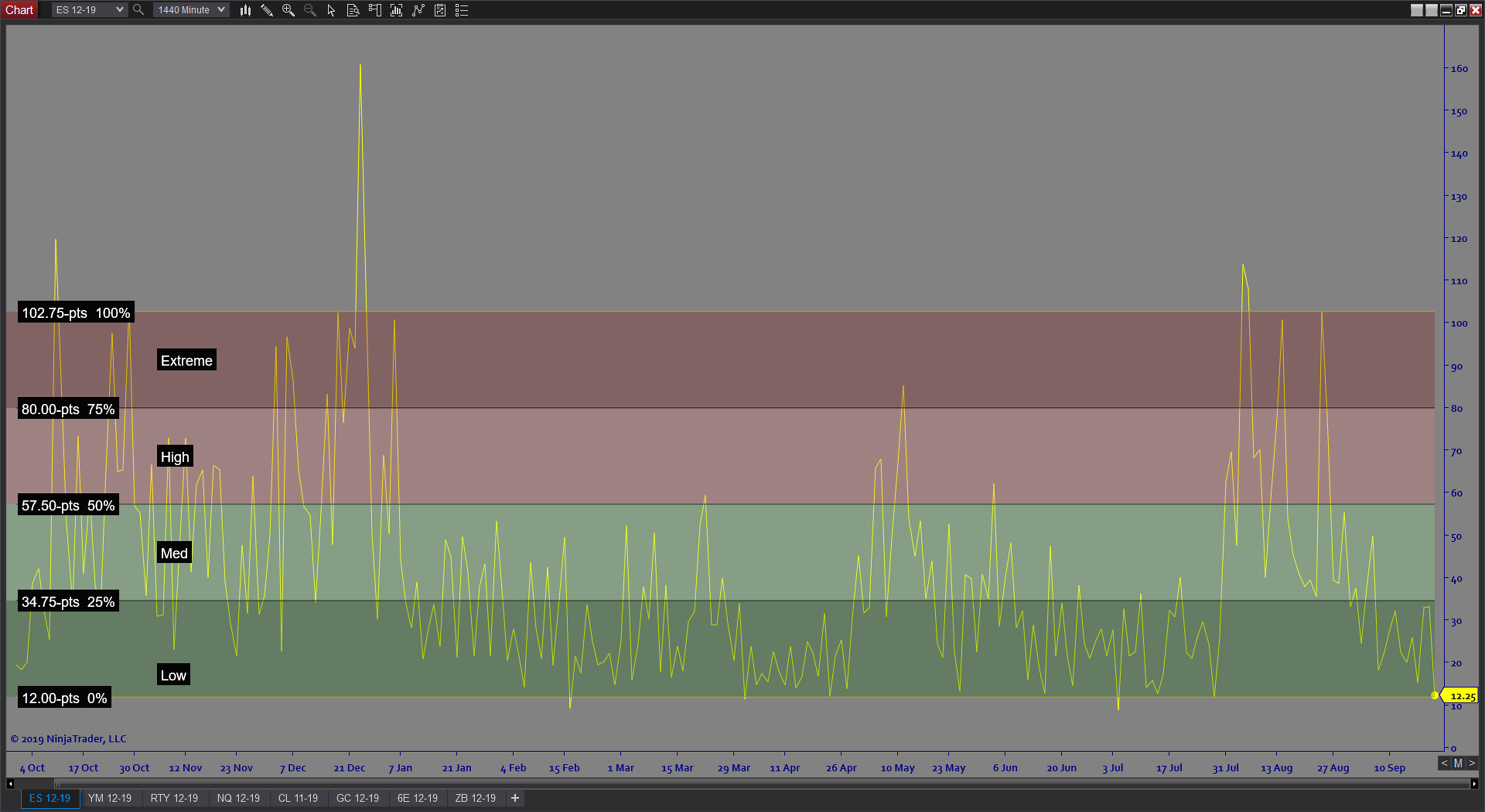

The ATRCurve software is a system add-on that scans market volatility. It forecasts market conditions, risk personas, system bias, and market selection. Using this will help determine when to enter and not enter your trade setups based on volatility conditions.

Purpose:

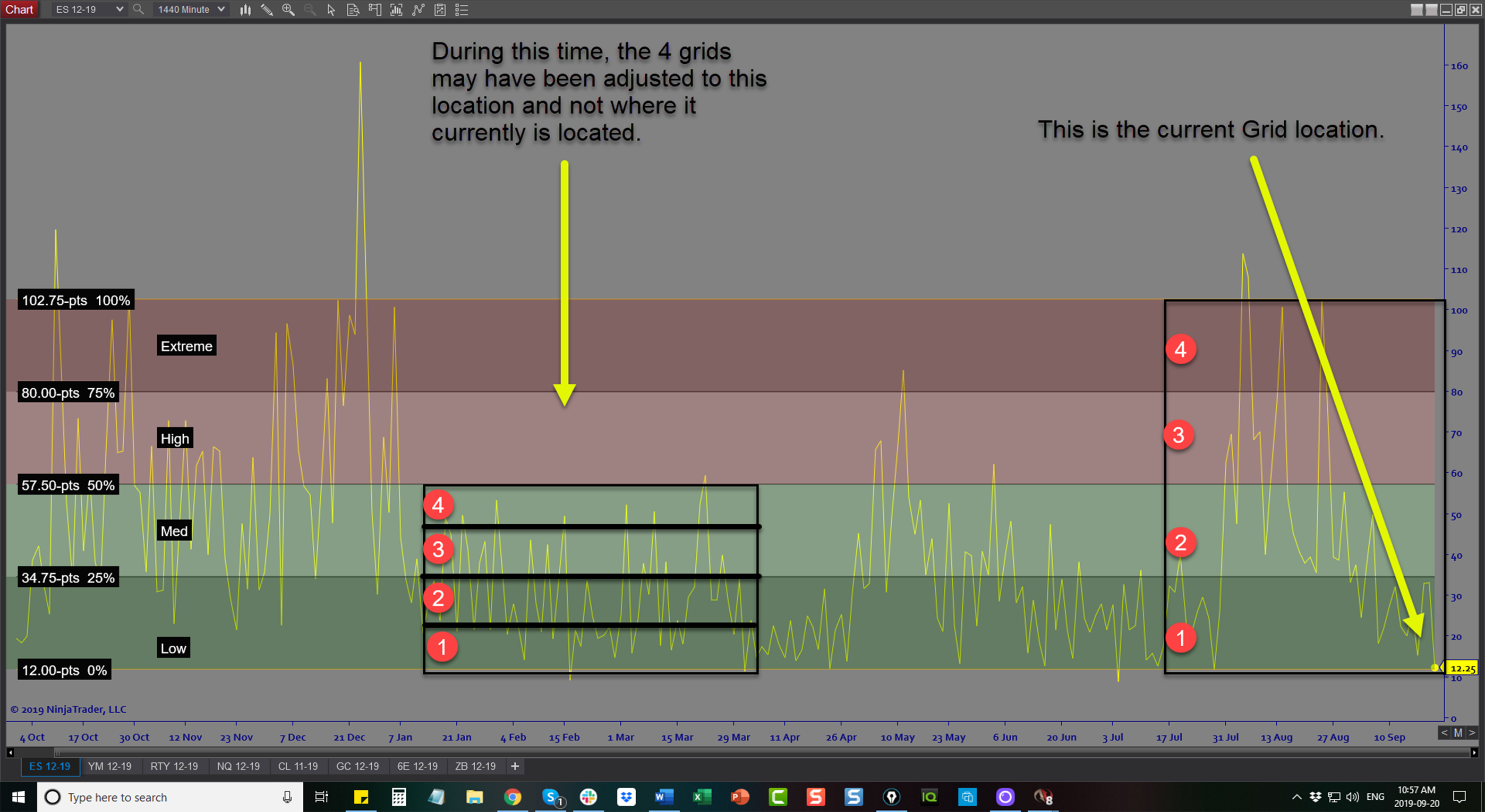

Traders need the ATRCurve software because unexpected increases in volatility can degrade your strategy’s performance if adjustments are not made. One of the best indicator of market volatility tracks volatility and applies a grid showing whether the current level of risk is low, high, or even extreme. This makes it easy to know when volatility conditions dictate that you should modify your trade plan or possibly stop trading until conditions normalize.

Elements:

- Real time volatility tracking

- Dynamic Grid of 4 Risk Levels (Low, Medium, High, Extreme)

- Customizable Lookback Period

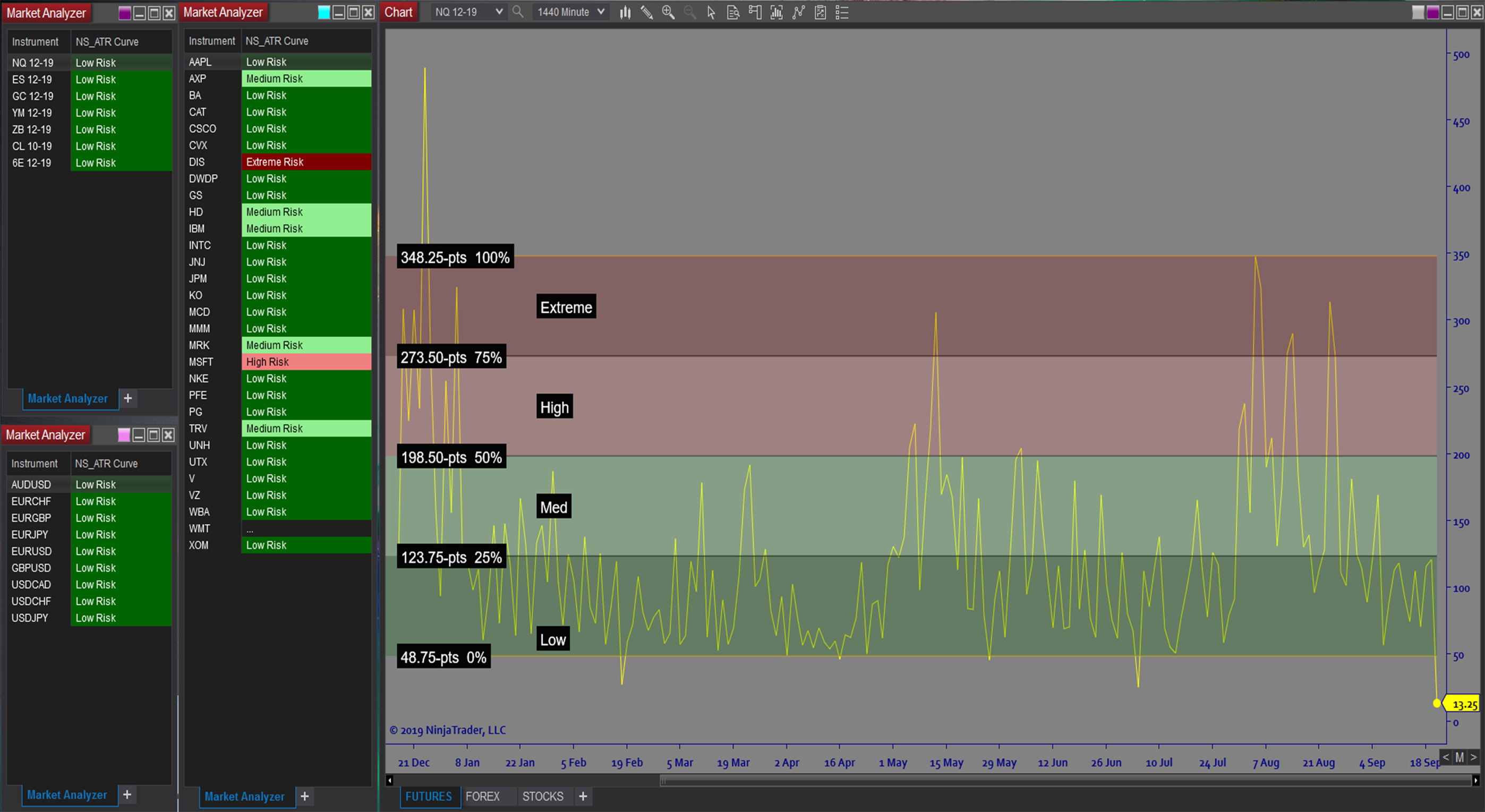

- Market Analyzer Scanner displays Risk Level across multiple markets

Functions:

The ATRCurve software is best used by keeping the Risk Grid visible in your workspace so you can monitor risk conditions and adjust your trading accordingly. If you trade multiple instruments, or you simply want to track conditions in other markets, setting up a scanner is an efficient way to monitor risk conditions without taking up much screen space.

Problem Solved:

- Stops traders from losing track of market conditions

- Stops traders from failing to adjust to changes in volatility

- Stops traders from getting stopped out because their stops are too tight

- Stops traders from trading when conditions are not safe

- Stops traders from second guessing trade timing