The AT Trader Algo – How to Trade Trend Reversals Like a Pro

About Author

Samwel

The AT Trader Algo uses trendline detection to scan for reversal setups and executes trades when a trendline is broken. It effectively defines a valid trendline breakout and automates trendline reversal trading strategies.

Trendlines occur in every market and in every timeframe all the time. That alone makes trendlines one of the most valuable tools in any trader’s arsenal. However, the price action periodically tests the trendline, making it difficult to know when the trend is over. This is where automated trendline trading strategies like the Automatic Trendline (AT) Trader Algo come in.

While the AT Trader Algo is an automated trendline reversal system, you must first understand how trendline reversals work. We’ll discuss what trendlines are, how to draw them, how to trade trendline reversals, and finally, how to automate trendline trading strategies with the AT Trader Algo.

What is a Trend Reversal in Trading?

A trend reversal is a change in the direction of the current trend. For example, when an uptrend changes into a downtrend or when a downtrend changes into an uptrend.

Note that trend reversals may vary depending on the timeframe you’re trading. A market reversal in a 15-minute timeframe may still be a trending market in a 1-hour timeframe. So, if you’re interested in trading trend reversals, you’ll need to ensure that the price action satisfies all the conditions for a reversal setup. This is where trendlines come in. They are arguably one of the most important tools when trading trend reversals – they help you identify support and resistance regardless of the market structure.

Trend Reversals vs Retracements

Every trend reversal starts as a market correction, meaning a market reversal begins as a trend retracement. A trend retracement is a short-term market correction with a temporary price reversal within the dominant trend. Retracements are short-lived, shallow compared to the prevailing trend, and have a decreasing trading volume.

In an uptrend, retracement is a slight pullback where the price drops before the bullish trend resumes.

Similarly, a retracement in a downtrend is a temporary rise in the price before the bearish trend continues.

Now that you understand the difference between trend reversal and retracement, the question is, how do you ensure you aren’t trading trend retracements instead of trend reversals? The answer lies with the trendlines.

Trendlines in Trading Explained

In technical analysis, trendlines are one of the most critical components in trading reversals – they help you identify support and resistance levels. A trendline is a straight line drawn on a chart connecting consecutive highs and lows. However, a trendline is only valid if the price action touches at least five points without a breakout. All trading platforms offer various drawing tools that you can use to plot trendlines in any timeframe.

Types of Trendlines in Trading

There are three trendlines in trading: uptrend, downtrend, and sideways.

1. Uptrend Trendline

An uptrend trendline is an upward-sloping trendline connecting consecutive higher lows. It shows a bullish trend. Here, the uptrend trendline is the support level, and a confirmed breakout below signals a possible trend reversal.

2. Downtrend Trendline

A downtrend trendline is a downward-sloping trendline connecting consecutive lower highs. It signals an overall bearish market. A downtrend trendline is the resistance level, and a breakout above it signals a potential trend reversal.

3. Sideways Trendline

A sideways trendline is a horizontal trendline connecting either relatively equal consecutive highs or consecutive lows that are relatively equal. This trendline shows a range-bound trend, indicating the market is in a consolidation phase. The upper trendline is the resistance, and the lower is the support.

It’s worth noting that these trendlines can’t always be picture-perfect. In most instances, price action may stray outside the trendline without being a confirmed breakout.

How to Identify Trendline Reversals

The simplest way to visually identify a trend reversal is through a confirmed breakout from the trendlines. A breakout is only valid if the breakout candle closes outside the trendline and the subsequent candle opens above or below it.

Depending on the prevailing trend, a reversal can be bullish and bearish trend reversals.

Bullish Trend Reversals

A bullish trend reversal occurs when the price action changes from a downtrend to an uptrend. To identify a bullish trend reversal, first identify an overall bearish market. Secondly, draw a downtrend trendline connecting the consecutive lower highs, forming the resistance level.

Finally, wait for a confirmed breakout above the downtrend trendline. Remember that an increase in the volume traded must accompany this breakout.

Bearish Trend Reversals

A bearish reversal occurs when the market trend changes from an uptrend to a downtrend. To identify a bearish trend reversal, first identify an overarching bullish trend. Secondly, draw an uptrend trendline connecting the consecutive higher lows, forming the trend’s support level.

Finally, wait for a confirmed breakout below the uptrend trendline, accompanied by an increase in the volume traded. The break below the uptrend trendline confirms a bearish trend reversal.

Automated Trendline Reversal Trading Strategies: The ARC AT Trader Algo

In any trending market, a trendline will often be tested with several pullbacks, making it difficult to know exactly when the trend is over. That’s why most manual traders unwittingly end up trading false breakouts.

To profitably trade trendline reversals, you must accurately identify a trend, draw a valid trendline, and monitor the price action for trend reversals. We’ve explained the manual approach in this guide – which, as we’ve seen, is subjective, can be tedious and may be prone to false breakouts.

So, what if you could do all this without manually calculating all the conditions for a reversal setup in real-time? What if you had an automated system that identifies a trending market, draws the trendline, establishes a buffer zone, and executes trend reversal trades for you? Well, there is such a trading system – the AT Trader Algo!

What is AT Trader Algo?

The Automatic Trendline (AT) Trader Algo is an automated trading algorithm that uses trendline detection to scan for reversal setups and executes trades when a trendline is broken. It automates trendline reversal trading strategies.

While it’s easy for traders to identify a trend visually, different traders may take different approaches when drawing trendlines. We mentioned that every trendline reversal starts as a pullback, and not every pullback becomes a trend reversal. That means most traders may prematurely trade pullbacks, mistaking them for full-on trend reversals. Worse still, trendline reversal trading strategies are prone to false breakouts, which may be hard to catch even for an experienced trader.

The AT Trader Algo forecasts trendlines based on pure price action and automatically plots and validates the trendline, including the buffer zone. That means position entries are not laggy. The algo then triggers long or short positions when the price action breaks out of the buffer zone. Since trendlines occur in all markets and timeframes, the AT Trader Algo is suitable for trading every market – stocks, futures, Forex, crypto – and every timeframe.

AT Trader Algo Trend Reversal Trading Strategy

The AT Trader Algo gives you 100% fully automated trendline break signals on any timeframe you trade. It’s designed with every trading style in mind – scalping, day trading, and swing trading. Given that trendlines form in tight, range-bound markets and during prolonged trending markets, the AT Trader Algo allows you to take advantage of trends in every market.

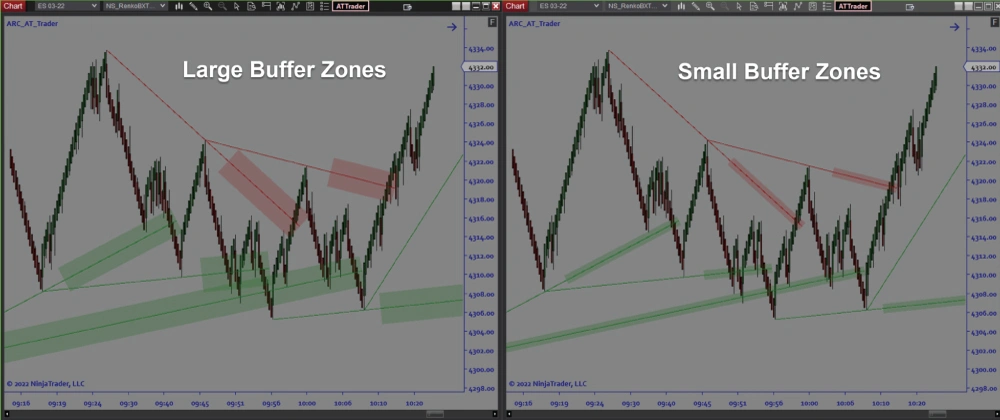

While manual traders only draw the trendline and watch out for a confirmed breakout, the AT Trader Algo automatically plots buffer zones within the trendlines, which vary depending on market volatility. These buffer zones serve as a safety margin around the trendline beyond which a trend reversal is confirmed. They aim to eliminate false breakouts by allowing for price fluctuations, especially in a volatile market, without invalidating the reversal setup.

The AT Trader Algo has trend filters to ensure you’re never caught on the wrong side of the market. Although trendlines occur in every timeframe, that doesn’t mean they’re all optimal for trading trend reversals.

AT Trader Algo’s Auto-adaptive Risk and Money Management

The AT Trader Algo automates every aspect of trading trendline reversals – from drawing and validating trendlines to identifying trendline breaks, stop loss placement, risk and position sizing, breakout buffers, Open, High, Low, and Close (OHLC) buffers, trend filters, and EMA filters. Even better, you aren’t just getting a black box. You can change AT Trader Algo’s trading parameters to suit your trading style, risk management, and money management preferences.

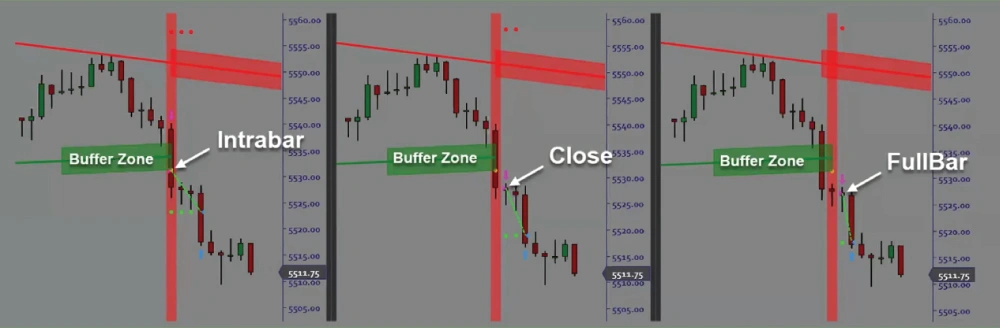

Even when trading manually, the entry rules for trading trendline reversal depend on how the price action breaks the trendline. The trendline breakout will differ depending on the chart you use – variable range bars, Renko charts, or normal time-based or tick-based charts. That’s why the AT Trader Algo comes with fully optimized templates with three different entry mechanisms.

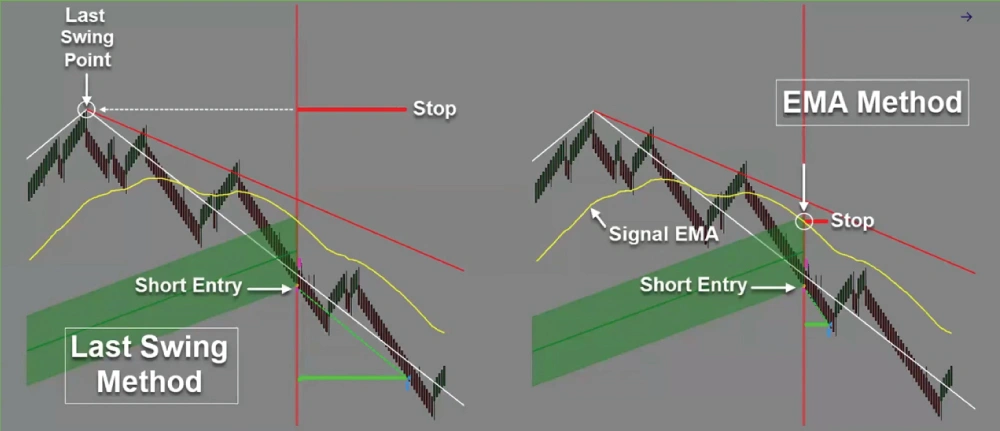

Regarding risk management, the AT Trader Algo has two types of dynamic stop loss settings to suit your needs. Depending on the prevailing volatility, you can set a tight stop loss based on the EMA indicator or a market structure-based stop loss.

The algo also has dynamic money management with auto-adaptive position sizing depending on your risk management. This ensures consistent risk and money management since the size of every position you trade will depend on the size of your stop loss.

AT Trader Algo stands out from other automated trading systems because it comes with fully optimized templates that especially work well for prop traders. That means you won’t spend hours optimizing the algorithm.

The Bottom Line

The trend is your friend until the end, and when the trend ends, a new one is bound to start. However, you cannot know what’ll happen next when monitoring real-time price action. As discussed, you can use chart patterns, volume, and volatility analysis to determine potential trend reversals. While these increase your shot at catching a trendline reversal, what will give you an edge is a trading algo that specifically automates trendline reversal trading strategies. That’s the AT Trader Algo.

With an automated trendline reversal system, like the AT Trader Algo, you can auto-trade trend reversals without worrying about false breakouts. The trading algorithm plots and validates the trendline and only opens long or short positions when there is an actionable reversal setup.