Overview:

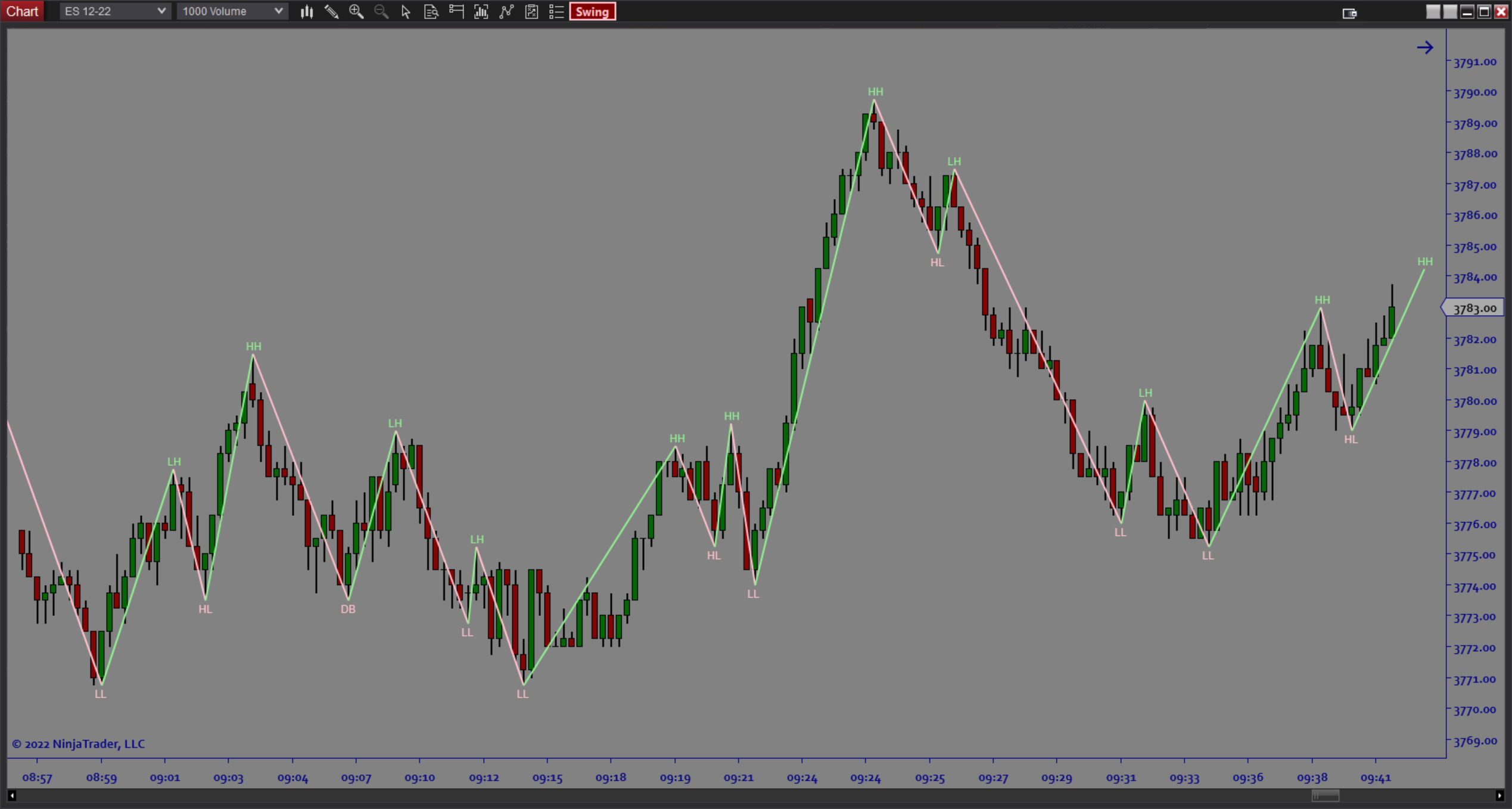

The SwingStructure software overlays Swing Trading Trend Lines on the price bars to map out market structure. These are Zig Zag lines which connect the swing highs and lows. The only way to truly understand market structure is to systematically track higher lows for uptrends and lower highs for downtrends. The SwingStructure software does this for you by labeling each swing point. If desired, the Swing Strength can be adjusted to ignore the smaller swings and focus on the major ones.

Purpose:

Traders need the SwingStructure software because understanding market structure is essential to being successful in trading. When buyers are in control, the lows tend to hold and the highs get broken (opposite for sellers). By knowing what to look for you know the exact moment of a trend change. The SwingStructure software makes it easy to stay on the right side of the market with clear Zig Zag lines and Swing Labels.

Elements:

- Customizable Zig Zag lines connecting swing highs and lows

- Swing Labels (HH,LL,HL,LH)

- Adjustable Swing Strength

Functions:

The SwingStructure software is best used by adding the Zig Zag lines to your trading chart and using the swing labels to keep track of market structure while you are trading. This ensures that you do not trade against directional bias and also know when to switch from being a buyer to a seller.

Problem Solved:

- Stops traders from second guessing market structure

- Stops traders from trading the wrong side of the market

- Stops traders from wasting time comparing swing levels

- Stops traders from ignoring market context