Overview:

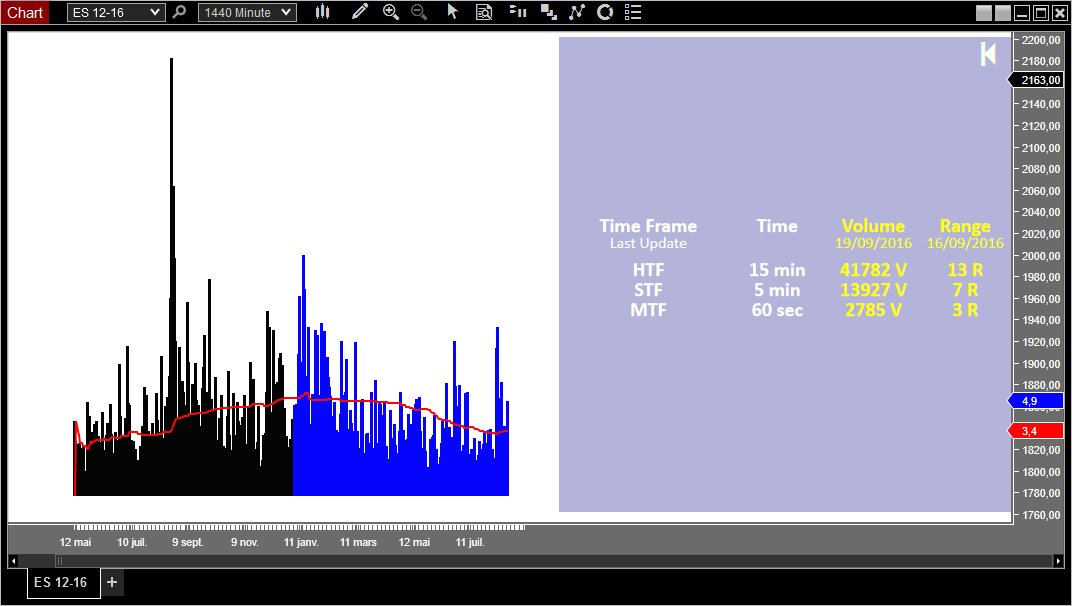

Fractal Converter is an all-inclusive indicator used for converting time-based trading charts to either volume or range based trading charts. For example, if you want to know what size your Range bar is equivalent to a 5 Minute bar, you can find out instantly with this tool. It takes the guesswork out of converting Minute charts to other bartypes.

Purpose:

Traders need the Fractal Converter Software if they want to trade a Range or Volume chart but don’t know what fractal size to use. If your risk model is based on a 5 minute chart, how do you know what size your Range bars or Volume bars need to be? The software algorithm processes hundreds of days of historical data to find the equivalent fractal size to generate the similar indicator values and stop sizes. This eliminates trial and error and instills confidence in your strategy.

Fractal Converter Elements:

- Converts Minute based fractals into their equivalent Range or Volume based fractal sizes

- 3 Customizable Conversion Fractal Sizes

- Bar Count Equivalence Methodology

- Customizable Lookback Period for historical analysis

- Customizable trading sessions for each market

Functions:

The Fractal Converter software is best used before trading when you are defining your strategy and setting up your charts. If any of your charts are Range-based or Volume-based, you can easily convert Minute charts into the appropriate fractal sizes. The conversions are based on a large amount of historical data but it is advisable to periodically check your conversions for any adjustments required.

Problem Solved:

- Stops traders from second guessing fractal size

- Stops traders from missing out on the benefits of volume or volatility based bartypes

- Stops traders from failing to fine tune their setups to each market traded

- Stops traders from getting stopped out because their fractal size is wrong

- Stops traders from wasting time manually performing statistical analysis