ATR Trailing Stops Indicator

THIS PRODUCT IS INCLUDED WITH THE ALL-IN-ONE SUBSCRIPTION

- 30+ Proprietary Algos

- 50+ Advanced Indicators

- 4 Complete Trading Systems

- In-Depth User Documentation

- White Glove Installation & Ongoing Support

- Prebuilt Optimized Strategy Templates

- Deep-Dive Video Courses & AMA Sessions

Only for Ninjatrader Platform

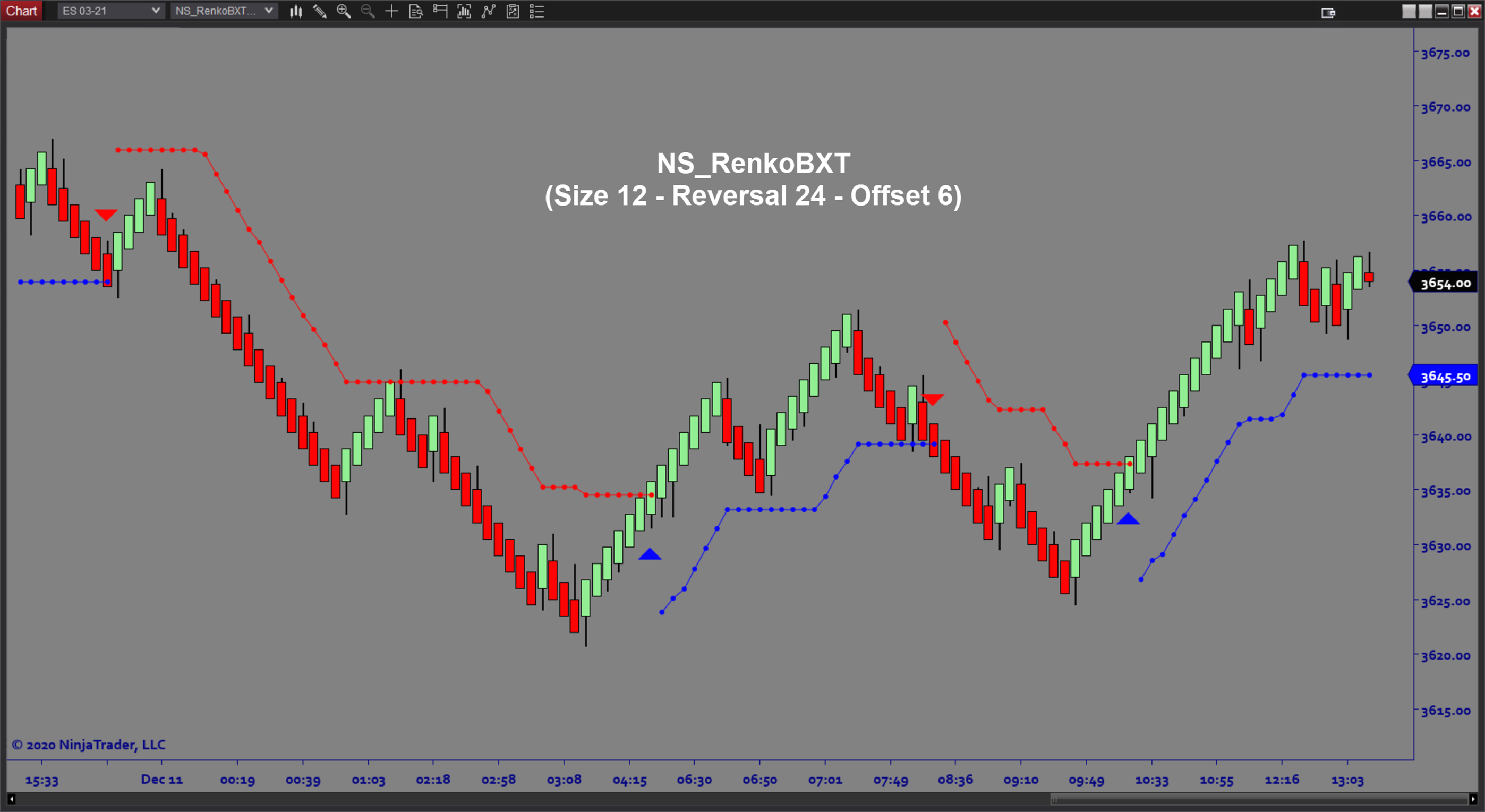

ATR Trailing Stops Indicator Overview:

ATR Trailing Stops displays an ATR-based trailing stop line which adjusts periodically behind the trending price bars. In an uptrend, the line is below the price bars. In a downtrend, the line is above. When the stop line is violated it flips to the other direction. This provides a handy visual guideline for stop placement which adjusts with changes in volatility. The user can customize how closely the stop line hugs the trending bars.

Purpose:

Traders need the ATR Trailing Stops indicator because risk management should always take into account any changes in volatility. Your normal stop size may be too tight when volatility spikes. The software displays a trailing line to help you locate your stop orders. Knowing that the stop line reflects recent market conditions gives you confidence when managing risk.

Elements:

- Trailing Stop line behind trending price bars

- Short and Long Trailing Stop Lines

- Stop Line remains flat during pullbacks in price

- ATR-based Trail Amount

- User Defined ATR Multiplier

- Trend Change Markers

- Trend Change Alerts

Functions:

The ATR Trailing Stops software is best used by first having a risk management plan and then adjusting the ATR Multiplier so that your trailing stop lines are consistent with your risk tolerance. Once you have the settings fine tuned, using the trailing stop lines to manage your stop placement will ensure that you are managing risk consistently.

Problem Solved:

- Stops traders from second guessing stop placement

- Stops traders from getting stopped out when volatility spikes

- Stops traders from failing to recognize changes in market conditions

- Stops traders from taking undue risk because they don’t know how to adapt

- Stops traders from second guessing entry locations

- Stops traders from not knowing when to exit a trade