Description

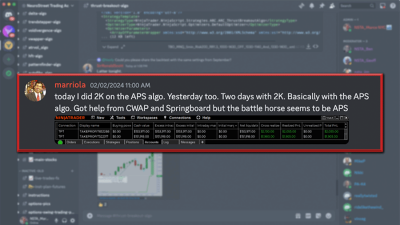

Alpha Price Scalper Algo

The ARC_APS Algo (“Alpha Price Scalper”) is a pure price action-based automated trading solution for Ninjatrader which scans for exploitable micro price patterns to generate breakout trade setups.

The APS Algo is best used by first selecting your favorite instruments to trade and identify a suitable scalping timeframe. Then take advantage of the backtesting and optimization capability to fine tune the strategy parameters. Next you can forward test your strategy in live simulation mode. And once you achieve consistency you can deploy the algo using risk capital. The advantage of the system design is that the number of parameters needed to define the strategy for your trading instrument is relatively small. This means that not only can you complete your strategy development rather quickly but you can also easily adapt to changing market conditions.

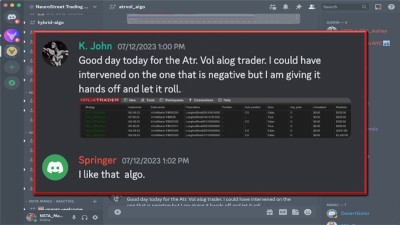

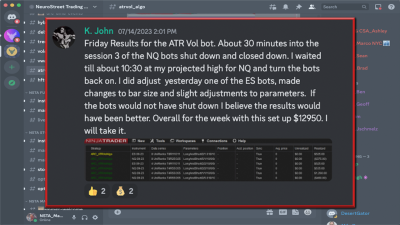

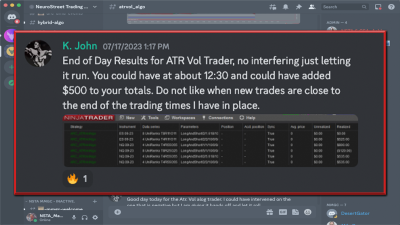

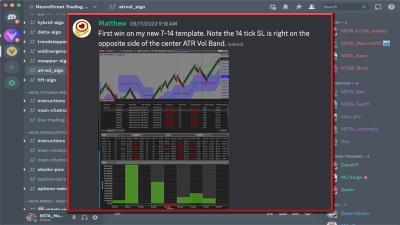

ATRVolatility Algo

The ATRVolatility Algo is an automated trading solution for Ninjatrader which uses a volatility adjusted trailing stop line with a volatility band for signal generation.

The ATRVol Algo is best used by finding profitable system parameters and letting the software do what it is designed to do: scan for good trade signals, entering the market when the setups occur, and automatically managing those positions until an exit condition occurs. The best approach is to take advantage of built in backtesting and optimization capability to find the best settings. The system is well suited to exploit instruments which display significant variations in volatility over time. The key is to follow the steps from design and optimization to Sim trading and only when performance is validated to actually autotrade a live account.

AutoFib Algo

The ARC_AutoFib Algo is an automated trading solution for Ninjatrader based on the confluence of Fibonacci sequences across multiple timeframes.

The AutoFib Algo is best used by setting the chart timeframe to fit your trading style and then selecting a higher timeframe for the background Fibonacci confluence calculations to ensure that you are trading only the strongest support and resistance levels. Next set up the trade entry Buffer Zones to reflect the volatility of the instruments that you are trading. Next, leverage the power of the flexible core trading engine to customize your trade plan, trend and momentum filters as well as enable money management functionality to protect trading capital. The built in optimization and backtesting will help refine your settings. Lastly, always be sure to trade in Sim to establish stable performance before risking live capital.

PatternFinder Algo

The PatternFinder Algo is an automated trading solution for Ninjatrader which uses pattern recognition to locate breakout pattern setups which can be used to autotrade any instrument and timeframe

The PatternFinder Algo is best used by finding the best market structure settings for the specific instruments you trade. This in turn determines the frequency and the expected size of the move once the breakout occurs. This helps with setting the stop size and target placement for the customizable trade plan which is an important component of the Autotrader. The built-in optimization and backtesting will help refine your settings. The key is to validate those settings with SIM trading and then when ready, allow the software to trade your account live for consistent profits.

RiskReward Entry Algo

The Risk Reward Entry Algo is an integrated solution for planning, entering, and managing trades.

The RiskReward Entry Algo software is best used by starting with a defined risk model. The software is designed to prevent you from taking excessive risk. Once you map out your next trade right on the chart, the software automatically enters the market at the moment your price is hit. The software then continues to manage the position while still allowing manual intervention to adjust stops, targets, and breakevens. When used as designed, the software makes it easier to focus on your trading and controlling risk.